Frequently Asked Questions

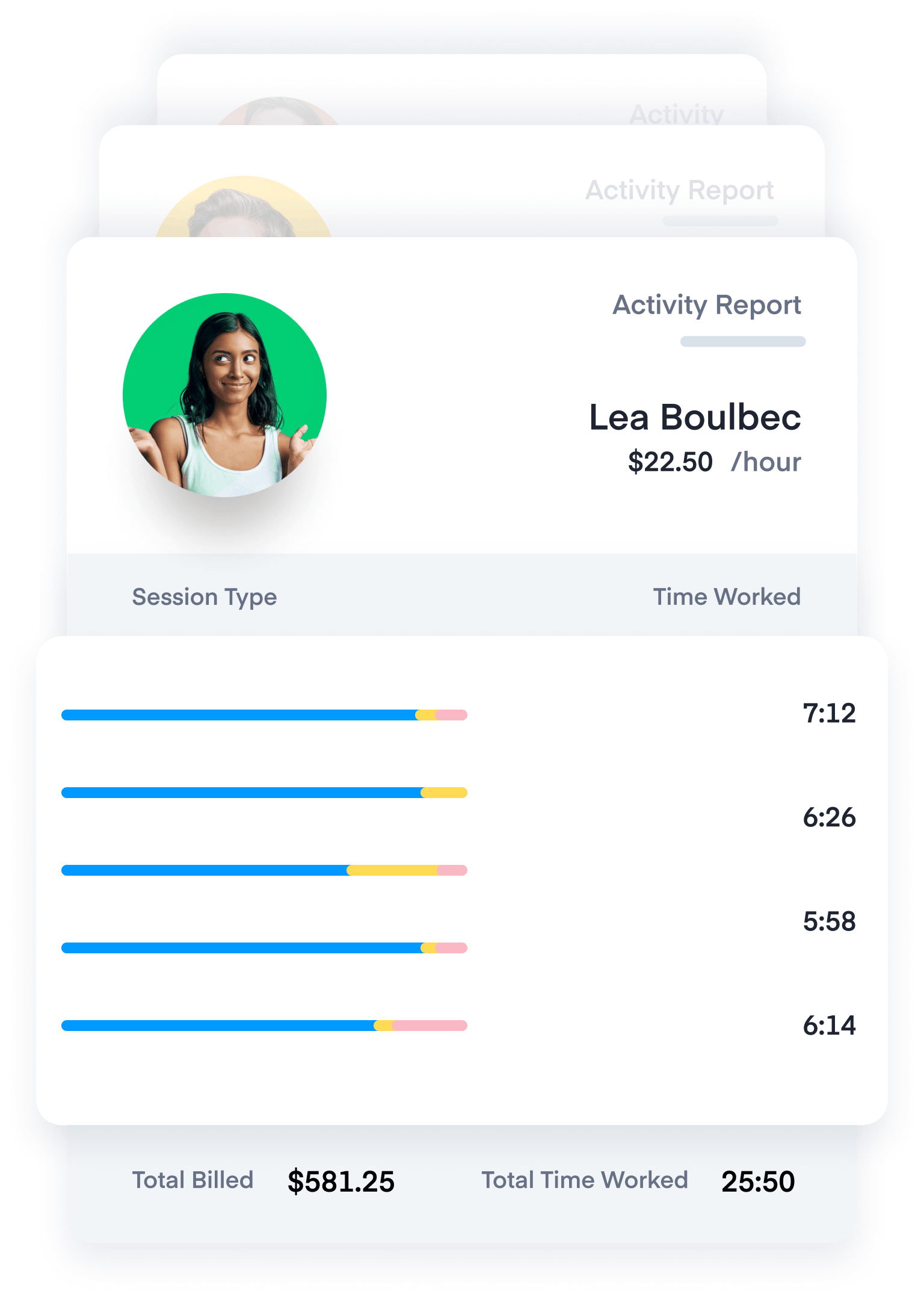

Absolutely! Many clients incentivize good performance by offering commission bonuses. These can be manually added to your weekly invoices.

Our billing period runs from Monday - Sunday, and contractors are paid weekly.

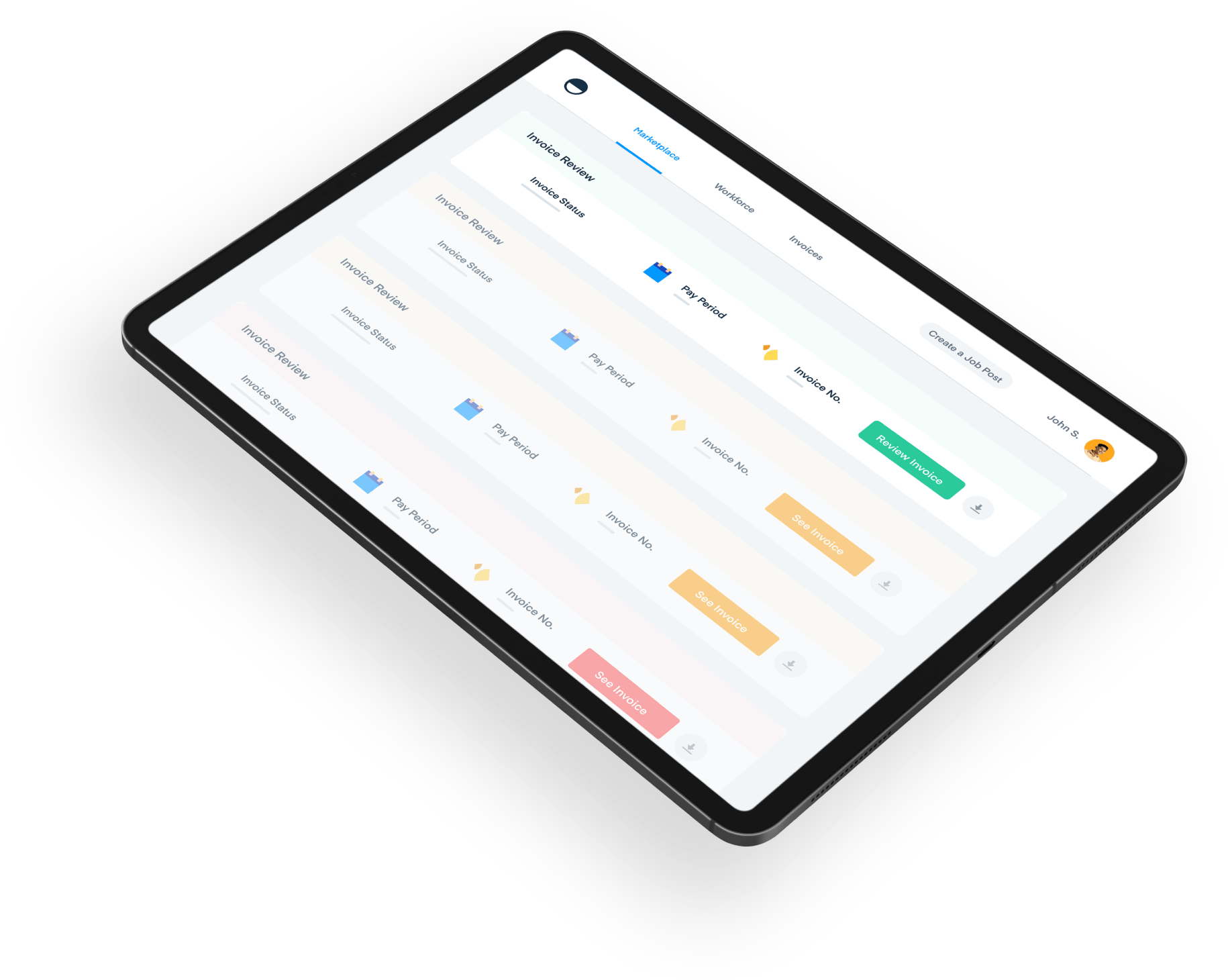

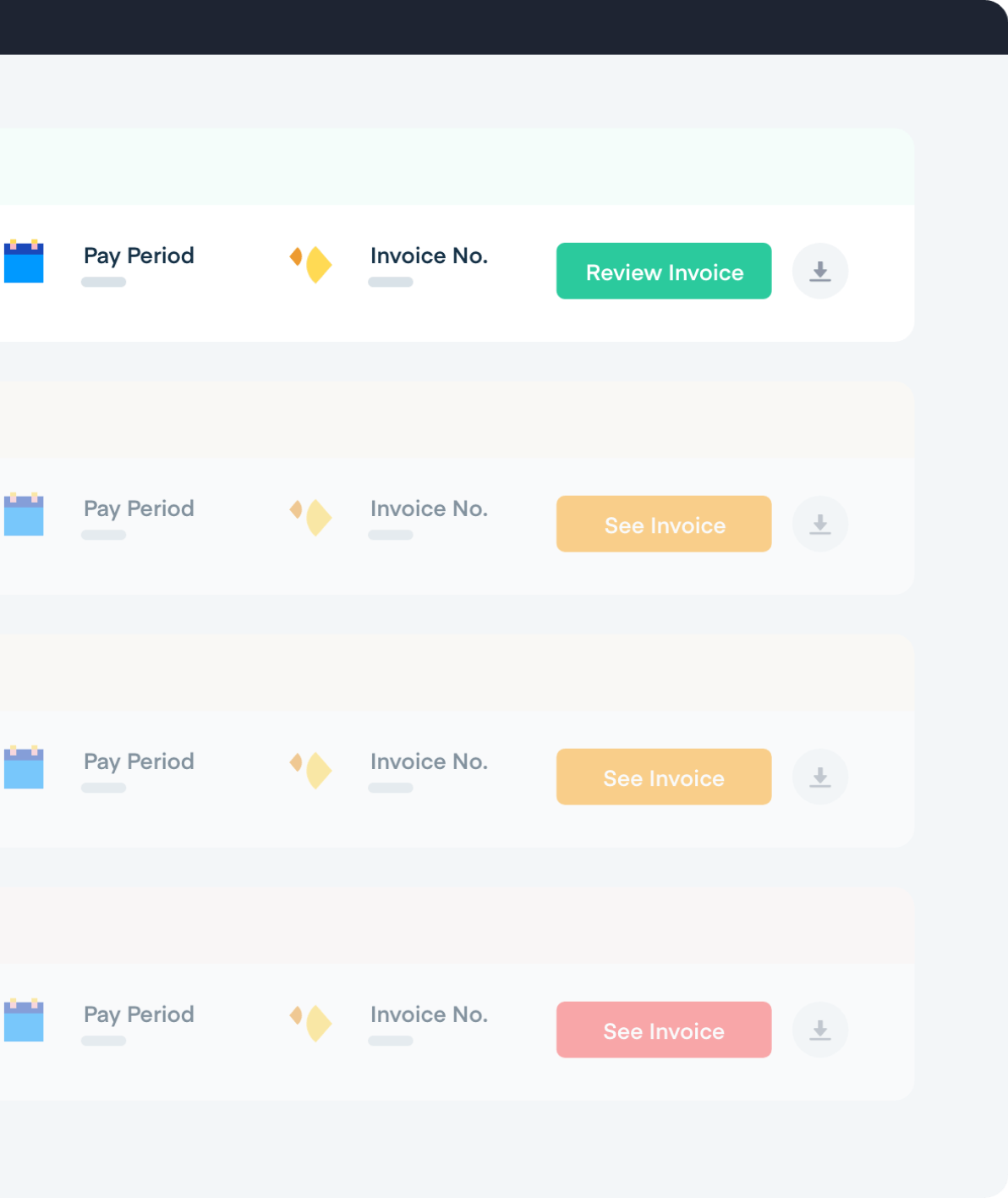

Every Sunday at midnight you will receive an invoice detailing the hours your contractor(s) worked during the previous billing cycle. You are notified of new invoices via email, and can also access them via our site itself. You then have 48 hours (all day Monday and Tuesday) to make adjustments, add any potential commission bonuses, and approve the invoice.

If the invoice is not manually approved prior to Tuesday at 11:59 PM (Eastern time), it will be auto-approved. Regardless of whether the invoice is manually or automatically approved, we’ll charge your card on Wednesday, and process payments to your team on Thursday.

No. As the employer of a freelance contractor, you do not have any tax obligations. At tax time, we provide contractors with a summary of their yearly earnings through Overpass, which they report as additional freelance income. As per the most recent iteration of the U.S. Tax Code, Overpass is considered a “payment settlement entity,” and is neither obligated nor expected to provide 1099 forms to contractors who find freelance work through our platform.

We apply a 3% processing fee to all credit/debit card transactions.

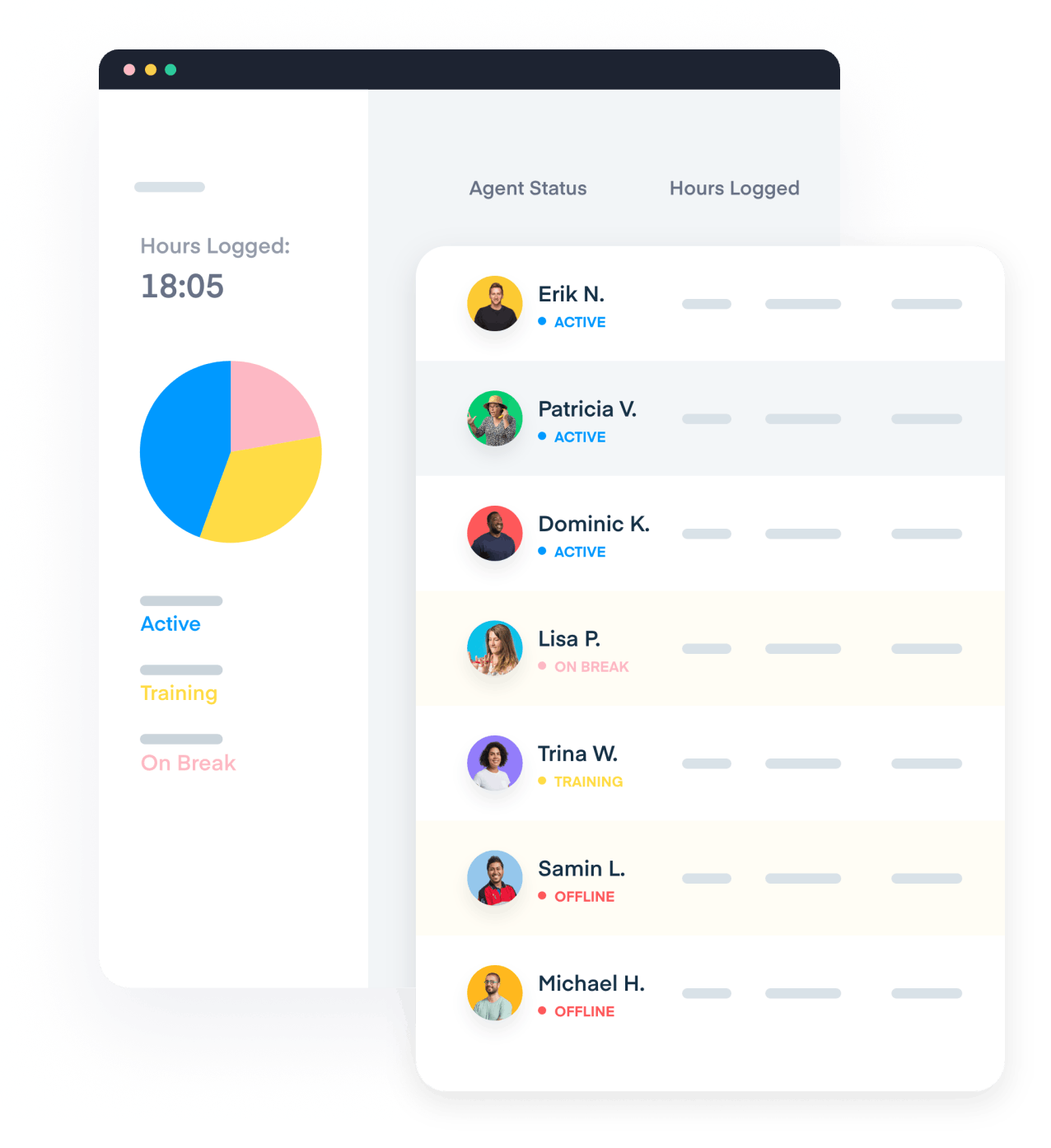

We use a system called “Status-Based Billing,” which allows us to monitor the total amount of time that a contractor was logged into your workspace. Contractors use a drop-down menu to identify when they are actively working versus taking a break. Our system automatically logs agents out after 15 minutes of inactivity to prevent over-billing.